6 Simple Techniques For Paypal Business Loan

Wiki Article

Facts About Paypal Business Loan Uncovered

Table of ContentsPaypal Business Loan Fundamentals ExplainedPaypal Business Loan Fundamentals ExplainedPaypal Business Loan Things To Know Before You BuyMore About Paypal Business Loan

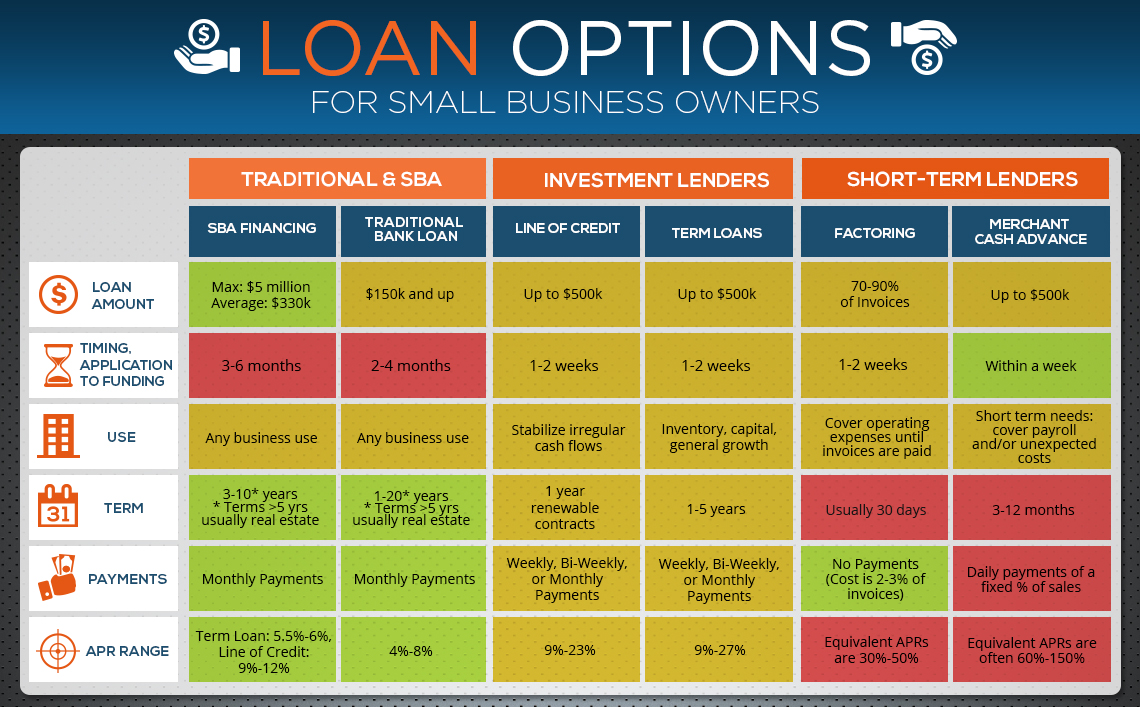

The SBA acts as the guarantor in between the borrower as well as the lender (PayPal Business Loan). In return, lending institutions provide their conditions, rate of interest price caps and also various other criteria which require approval from the SBA.The SBA supplies various plans as well as you can pick any strategy which might match your company requirementfor instance, getting stock, paying financial obligations or home mortgages, expanding your company, or also for getting property.SBA lendings do call for a complete application procedure, an individual credit report check, as well as collateral requirements, so they aren't right for everyone. When you listen to the word "loan," a term finance from a significant financial institution is possibly among the first things that enters your mind. A term funding is defined as a lump sum, paid to a customer with an agreement to settle it over a collection period of time, with rate of interest - PayPal Business Loan.

All you need to do is to stay within that credit line. Use your credit sensibly as well as make prompt regular monthly repayments, and also you can utilize the credit rating amount as lot of times as you like while constructing a positive credit report for your business. Entrepreneur that do not have collateral or a strong sufficient credit report to get term finances can rely upon company bank card for fast financing.

Debt spiral threat: It is simple for balances and also interest to accumulate if you are unable to make your regular monthly settlements in a timely manner. If you miss out on one payment, the unsettled balance surrender to the following payment duration, and you will be billed rate of interest on the brand-new amount, meaning your following settlement will certainly be higher.

Get This Report about Paypal Business Loan

This can quickly develop an ever-increasing hole of financial obligation and it's extremely difficult to climb out without a huge mixture of cash. Credit report restrictions: All service charge card include limitations, as well as staying within your restriction can occasionally prove to be a trouble. You might get around this by utilizing multiple cards, or you may have the ability to negotiate greater limitations over time.However, when it involves charge card, you're at the grace of the credit copyright. Can not use it for all types of payments: you could try this out Small company proprietors that need quick funding to make pay-roll or pay rent usually can not utilize charge card to make these specific sorts of settlements. Based upon your personal debt: Even most company credit report cards are still linked to the business proprietor's individual credit report.

One advantage of a Merchant Cash Advance is that it is fairly very easy to get. An additional advantage is that entrepreneur can receive the cash within a couple of days. It is not suitable for companies which have couple of credit history card purchases, since they won't have adequate purchase quantity to get approved.: In invoice factoring, the lending institution purchases unsettled invoices from you as well as provides you many of the billing quantity upfront.

Billing factoring permits you to get the cash that you require for your organization without waiting for your consumers to pay. You must also have solid credit score history as well as a track record of consistently-paying clients.

The Buzz on Paypal Business Loan

Allow's take a comprehensive consider how Fundbox operates in order to comprehend why it can be an excellent option for your company funding. Right here are some things to learn about Fundbox: Choice click for more info within hours: You can sign up online in seconds and also obtain a credit report choice in hrs. As soon as you determine to sign up, all you need to do is link your bookkeeping software or service bank account with Fundbox.

As a little business owner, you know that there are a whole lot of funding discover this info here choices out there. Take right into consideration the adhering to data about your business before making your following move: Personal credit history rating: Take a look at your individual credit rating.

Unknown Facts About Paypal Business Loan

If your credit rating is typical or low, after that you will most likely need to pay greater interest rates or you might be declined entirely. Company credit rating: Make certain that your company has a good credit rating rating, as the lending institutions will take your organization credit history into consideration prior to accepting it for a finance.Organization revenue: The borrowing options will certainly differ depending on the method your organization creates profits. It made use of to be that a significant bank was one of your only alternatives for getting access to a company line of credit rating, yet not any longer - PayPal Business Loan.

Report this wiki page